Can the UK meet construction goals during a critical trades shortage?

25 September 2024The UK construction industry is facing a critical workforce shortage. Many factors, including economic and social outliers, have caused growing concern across the industry with projected figures of workers needed increasing each year in order to meet future demand.

36.3% of construction firms in the UK were suffering a worker shortage as of December 2022. That’s roughly 1 in 3 construction firms in the country.

The Construction Industry Training Board (CITB) is an authority in market intelligence that provides annual Construction Skills Network reports to the industry and the government. Within the data, it highlights key trends and forecasts to enable the government and industry as a whole to be better prepared in order to meet labour demands for the future.

Why is there a critical trades shortage in the UK?

Over the last 5 years, the number of construction workers in the UK has been in steady decline, with dramatic shifts in social, political, and economic climates all playing their part. The main factors impacting this decrease include:

- An ageing workforce

- Fewer EU-born workers

- COVID-19

- Cost of living crisis

- Declining apprenticeship starts

Which trades are the worst affected?

According to the latest CSN Outlook report, the additional recruitment requirement (ARR) needed for construction-specific occupations within the UK to keep up with anticipated demand includes:

Source: https://www.citb.co.uk/media/acbnbn5t/csn-national-report-final-report.pdf

For the additional workforce required, the trades that will likely be the worst affected by these shortages will be wood/carpentry trades, electrical trades and labourers (not elsewhere classified*).

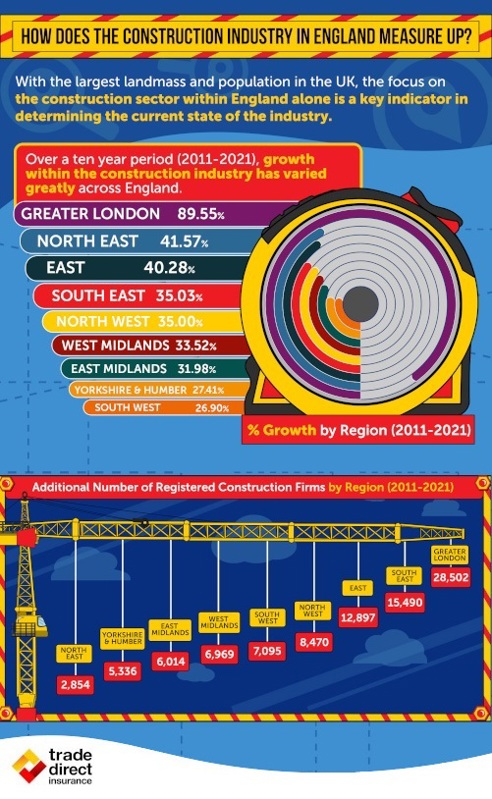

How does the construction industry in England measure up?

Over a ten-year period (2011-2021), growth within the construction industry has varied greatly across England:

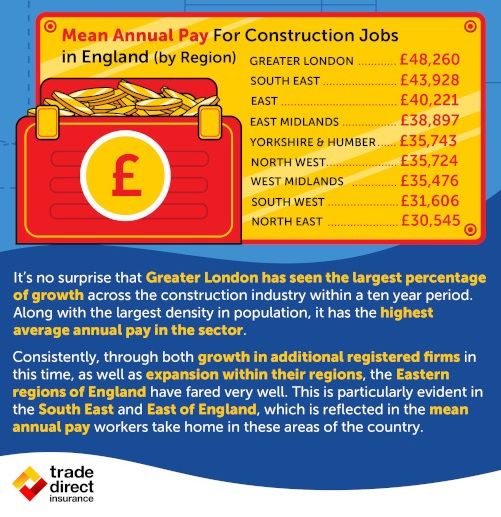

It’s no surprise that Greater London has seen the largest percentage of growth across the construction industry within a ten-year period. Along with the largest density in population, it has the highest average annual pay in the sector.

Apprenticeships: A foundation for the future

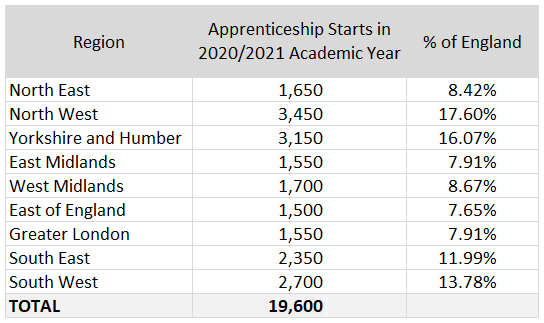

According to the latest CSN data there are around 74,000 construction apprenticeships currently enrolled across Great Britain. 45% of companies claim to offer apprenticeships but only 1 in 5 employ an apprentice. There were more than 33,000 apprenticeships started across Great Britain during the academic year of 2021/22. There were approximately 19,600 apprenticeship starts in England alone during the previous academic year of 2020/21.

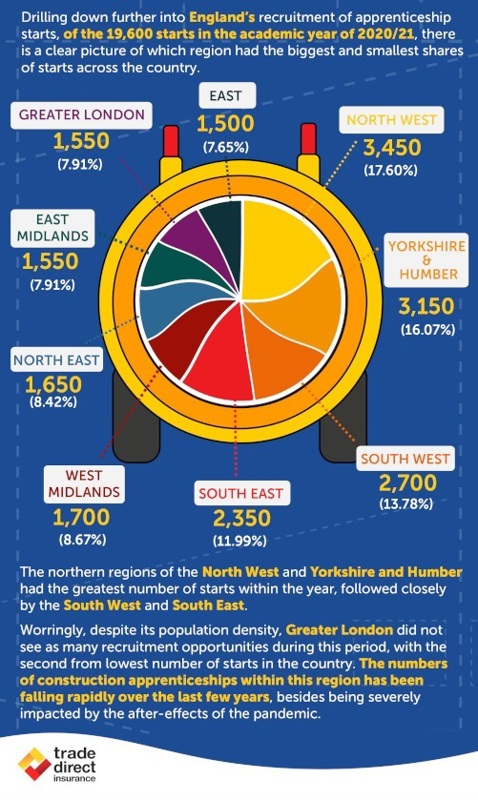

Adding new recruits into the mix

Drilling down further into England’s recruitment of apprenticeship starts, of the 19,600 starts in the academic year of 2020/21, there is a clear picture of which region had the biggest and smallest shares of starts across the country.

The northern regions of the North West and Yorkshire and Humber had the greatest number of starts within the year, followed closely by the South West and South East.

Worryingly, despite its population density, Greater London did not see as many recruitment opportunities during this period, with the second from lowest number of starts in the country. The numbers of construction apprenticeships within this region has been falling rapidly over the last few years, besides being severely impacted by the after-effects of the pandemic.

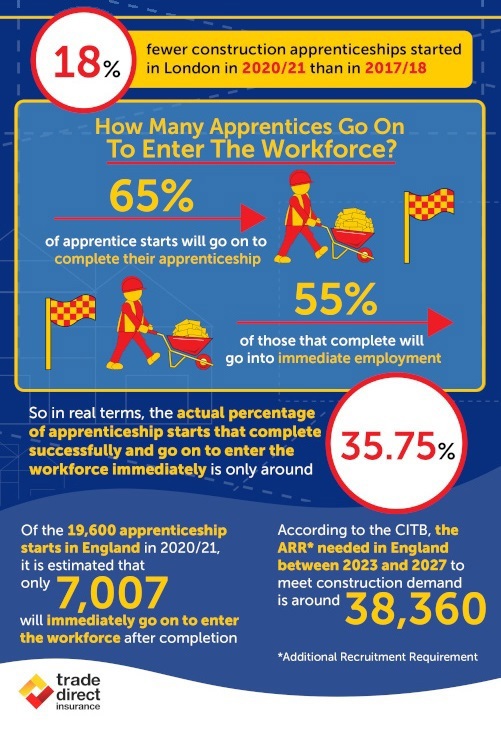

18% fewer construction apprenticeships started in London in 2020/21 than in 2017/18.

How many apprenticeships go on to enter the workforce?

65% of apprenticeship starts will go on to complete their apprenticeship. 55% of those that complete will go into immediate employment. So in real terms, the actual percentage of apprenticeship starts that are completed successfully and go on to enter the workforce immediately is only around 35.75%.

According to the CITB, the AAR needed in England between 2023 and 2027 to meet construction demand is around 38,360. Of the 19,600 apprenticeship starts in England in 2020/21, it is estimated that only 7,007 will immediately go on to enter the workforce after completion. Which poses an interesting question – from where, and how, will the remaining 31,000+ trades people be recruited to meet annual ARR and future construction goals?

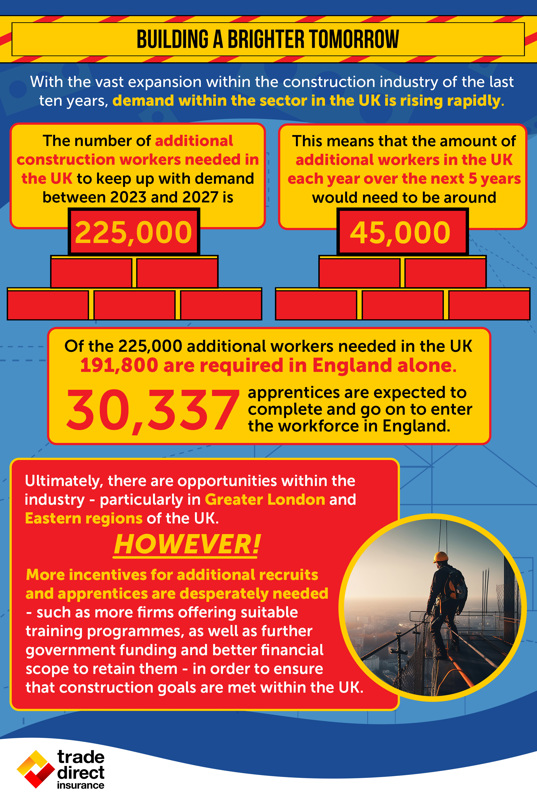

Building a brighter tomorrow

With the vast expansion within the construction industry of the last ten years, demand within the sector in the UK is rising rapidly.

The number of additional construction workers needed in the UK to keep up with demand between 2023 and 2027 is 225,000. This means that the amount of additional workers in the UK each year over the next 5 years would need to be around 45,000.

Of the 225,000 additional workers needed in the UK, 191,800 are required in England alone. 30,337 apprentices are expected to complete and go on to enter the workforce in England.

Ultimately, there are opportunities within the industry, particularly in Greater London and Eastern regions of the UK. However, more incentives to additional recruits and apprentices are desperately needed – such as firms offering suitable training programmes, as well as further government funding and better financial scope to retain them – in order to ensure that construction goals are met within the UK.

Sources:

https://explore-education-statistics.service.gov.uk/find-statistics/apprenticeships-and-traineeships

https://www.citb.co.uk/media/acbnbn5t/csn-national-report-final-report.pdf

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/costofliving/latestinsights

https://www.building.co.uk/news/number-of-furloughed-construction-staff-jumps/5110126.article

https://www.statista.com/statistics/751605/average-house-price-in-the-uk/

https://www.statista.com/statistics/1323328/weekly-earnings-in-the-construction-sector-in-the-uk/

Trade Direct is authorised and regulated by the Financial Conduct Authority. The company is a leading UK independent broker providing a wide range of policies to tradesmen and construction workers.

This note is not intended to give legal or financial advice, and, accordingly, it should not be relied upon for such or regarded as a comprehensive statement of the law and/or market practice in this area. In preparing this note we have relied on information sourced from third parties and we make no claims as to the completeness or accuracy of the information contained herein. You should not act upon information in this bulletin nor determine not to act, without first seeking specific legal and/or specialist advice. We and our officers, employees or agents shall not be responsible for any loss whatsoever arising from the recipient’s reliance upon any information we provide herein and exclude liability for the content to fullest extent permitted by law.